Introduction:

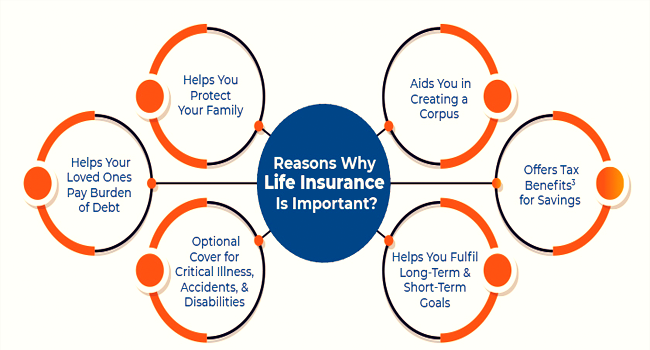

Life is unpredictable, and uncertainties loom around every corner. Amidst the joys and demanding situations of existence, one aspect remains regular: the want to protect our cherished ones. This safety extends past our physical presence, encompassing monetary protection and stability. In instances of unexpected activities, inclusive of accidents, illnesses, or untimely dying, the financial burden on our families can be overwhelming. This is wherein lifestyle coverage emerges as a vital tool, supplying a safe internet that guarantees our loved ones are protected against financial misery. In this essay, we delve into the importance of life insurance and the way it serves as a cornerstone in safeguarding our families’ future.

Understanding Life Insurance:

Life coverage is a contract between a man or woman and an insurance organization. The insurer guarantees to pay a delegated amount of money to the beneficiaries upon the insured’s death. In exchange for this financial protection, the insured will pay ordinary premiums to the insurance enterprise. The number one motive of life coverage is to provide financial security to dependents and beneficiaries in the event of the insured’s demise. It serves as a crucial device for coping with danger and ensuring that loved ones are not left at risk of economic trouble.

Protection Against Financial Uncertainty:

The unexpected loss of a breadwinner can have devastating effects on a circle of relatives’s monetary well-being. From loan payments to each day’s living charges, the economic duties continue with the lack of profits. Life coverage acts as a safety net, ensuring that dependents are not careworn with debt or forced to compromise their trendy of living. The death advantage acquired from life insurance coverage can help cover brilliant debts, funeral fees, and ongoing living charges, presenting a whole lot of wanted economic stability for the duration of a time of grief and transition.

Income Replacement:

For households reliant on the profits of 1 or more people, the absence of this financial assistance may be catastrophic. Life coverage gives income alternatives, making sure that dependents can hold their well-known of living even after the insured’s passing. By offering a lump sum payment to beneficiaries, existence coverage replaces misplaced earnings and enables households to meet their financial duties without undue problems. This income replacement element is especially crucial for families with kids, elderly dependents, or individuals with disabilities who rely upon the insured’s income for their livelihood.

Estate Planning and Wealth Transfer:

Beyond instant monetary protection, existence coverage performs an essential function in property-making plans and wealth transfer. For people with considerable assets or enterprise pursuits, existence coverage can facilitate the orderly switch of wealth to heirs and beneficiaries. By naming unique individuals or trusts as beneficiaries, policyholders can make certain that their belongings are allotted in keeping with their needs upon their death. Moreover, existence coverage proceeds are normally exempt from profits tax for beneficiaries, making it a green approach to passing on wealth to future generations.

Peace of Mind and Emotional Well-being:

The emotional toll of dropping a cherished one is giant, and the remaining component grieving households need to worry about is financial uncertainty. Life coverage presents peace of thoughts, knowing that one’s loved ones may be sorted financially in the occasion of tragedy. This piece of thought extends beyond the insured’s lifetime, imparting reassurance that even in their absence, they could hold on to provide for their family’s needs. By alleviating monetary strain and anxiety, life insurance promotes emotional well-being and allows households to recognize healing and rebuilding their lives without the burden of economic insecurity.

Types of Life Insurance:

Life coverage regulations are available in numerous bureaucracies, every one designed to meet unique monetary desires and targets. The two number one kinds of life coverage are period lifestyle coverage and permanent existence insurance. Term existence insurance presents insurance for a distinctive period, generally starting from 10 to 30 years. It gives pure loss of life gain protection and is ideal for individuals searching for low-priced insurance for a specific term, along with paying off a loan or presenting for kids until they attain adulthood.

Permanent lifestyle coverage, then again, affords lifelong insurance and includes a cash price element that accumulates over the years. This coin’s price can be accessed by way of the policyholder at some stage in their lifetime through policy loans or withdrawals, supplying a source of liquidity and economic flexibility. Permanent existence insurance rules, which include complete existence and usual existence, offer a mixture of death benefit protection and coins fee accumulation, making them suitable for lengthy-term economic planning and wealth upkeep.

Factors to Consider When Purchasing Life Insurance:

When purchasing life insurance, several elements must be taken into consideration to ensure good enough insurance and monetary safety. These elements include:

Financial Needs: Assessing your circle of relatives’s financial desires, together with amazing debts, dwelling charges, and future economic dreams, is crucial in determining the best amount of insurance wishes.

Budget: Consider your finances and affordability when deciding on a life coverage policy. Premiums must be viable within your budgetary constraints to ensure continued insurance without financial stress.

Health and Age: Your age and fitness status play a substantial role in determining insurability and premium charges. Younger, healthier individuals usually qualify for lower charges, while older individuals or those with pre-existing health conditions may additionally face higher prices.

Coverage Duration: Determine the length of insurance needed based on your monetary responsibilities and goals. Term lifestyle coverage may be enough for short-term needs, while permanent life coverage offers lifelong protection and cash cost accumulation.

Beneficiaries: Designate beneficiaries cautiously to ensure that the loss of life advantage is delivered consistent with your wishes. Consider factors such as dependents’ financial wishes, estate planning goals, and ability tax implications while naming beneficiaries.

Furthermore, lifestyle insurance can serve as an effective device for charitable giving and philanthropy. By naming charitable agencies or foundations as beneficiaries, people can make a lasting impact, and aid causes that are meaningful to them. Whether it is funding educational scholarships, assisting clinical research, or addressing societal issues, life insurance can be leveraged to make a fantastic distinction inside the international long after we’re gone. It’s essential to understand that life insurance isn’t just a monetary product but a method of keeping our legacy and providing for destiny generations. By taking proactive steps to steady ok coverage, we empower our cherished ones to navigate lifestyles’ uncertainties with self-belief and resilience. Life insurance gives a tangible expression of affection and protection, making sure that our families are equipped to stand anything demanding situations can also arise.

Conclusion:

In instances of uncertainty, being defensive of our loved ones turns into paramount. Life insurance serves as an essential tool in safeguarding our families’ financial future, providing a safety net that guarantees they are blanketed in opposition to unforeseen occasions. From earnings alternatives to wealth transfer and estate planning, existence insurance offers comprehensive economic safety and peace of thought. By expertise in the significance of lifestyle insurance and selecting the proper policy to satisfy our needs, we can take proactive steps to guard our cherished ones and stable their destiny of prosperity.